Spot and Fix ASIN Saturation in Amazon Campaigns

Introduction

ASIN saturation has become one of the more frustrating challenges for experienced brands using the Amazon ads platform. As more campaigns push the same product again and again, the performance trends start to shift. Impressions slow down. CPCs creep up. Conversion rates can fade even when the product is still strong.

The platform does respond to this kind of saturation behind the scenes, but those shifts aren’t always obvious right away. We’ve had to learn to spot the signals early and rethink how we structure campaigns to keep our ASINs from getting stuck.

Here’s what ASIN saturation really means, how the Amazon ads platform handles it, and how we can stay ahead of it as our product lines scale.

What Is ASIN Saturation and How It Affects Ad Performance

ASIN saturation happens when one product gets overloaded with ad placements across too many campaigns or similar tactics. The platform starts treating the product as overexposed, and performance takes a hit.

You’ll usually see it show up in a few ways:

Impressions flatten, even when search volume stays steady

Cost per click begins to rise without better results

Conversion rates weaken, especially on traffic from similar keywords or audiences

When saturation occurs, it generally stems from a few main causes. Campaigns might overlap heavily, targeting the same sets of keywords or audiences, which means budget and impressions are being split inefficiently. Using the same creative too often across multiple ad types can quickly wear out its impact and lower engagement. Limited variation in targeting, placement, or funnel strategy can also keep the product in front of the same audience, making ads seem repetitive.

Saturation can be slow to build, but once it kicks in, performance gets harder to recover without structural changes. This makes it critical to be able to notice when it's starting to develop.

How the Amazon Ads Platform Responds to ASIN Saturation

When ASIN saturation shows up, the Amazon ads platform starts changing how ads for that product are delivered. These shifts aren't flagged or explained directly, but we’ve noticed the patterns.

The auction and placement system reduces repeat delivery to protect customer experience

Ads may start showing in lower quality placements, or miss out on top-of-search even when bids stay high

CTR drops, leading the algorithm to slow delivery even further

From a seller’s point of view, this can sometimes feel like throttling, even though the goal is to keep ads from becoming stale. The signals are often subtle and require close monitoring of the data. Reports might look normal at first glance, but when you stack timeframes or compare across ad types, the differences become clearer.

If we’re pushing budget into a product that suddenly has a higher CPC, fewer impressions, and weaker returns, saturation is usually a good place to look.

Spotting ASIN Saturation in Campaign Data

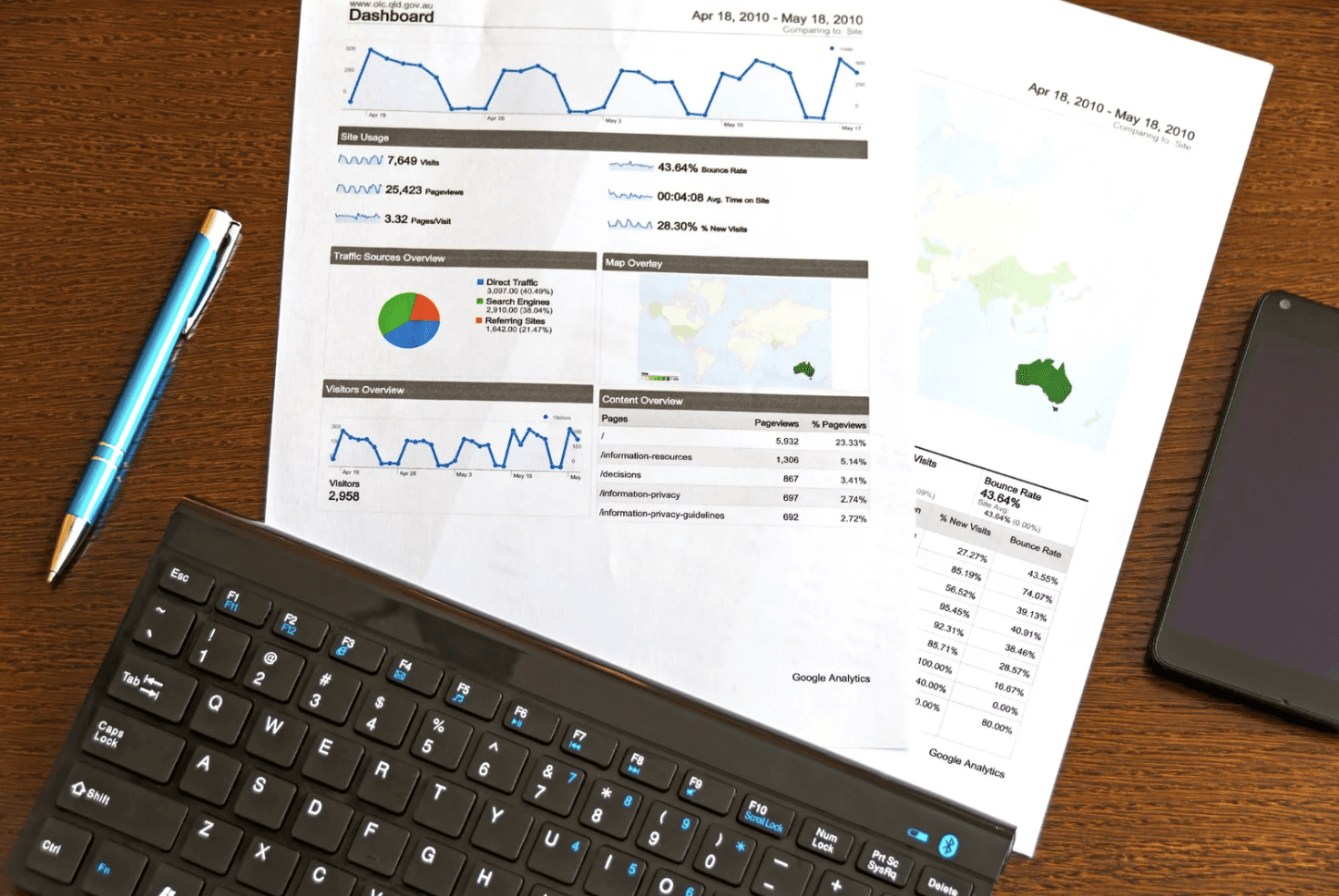

The better we get at reading campaign data, the earlier we catch these issues. ASIN saturation leaves clues, especially when we line up results across campaigns that target the same product.

Here’s where to focus:

Look for quick drops in impression share without any major changes in bid or budget

Keep track of click-through trends across creative variations; if they all fall at once, the platform may be backing off exposure

Monitor performance across your full ASIN catalog, not just the top sellers. Saturation often rolls downhill from overworked hero products

It’s important to review these patterns regularly. Seasonal shifts make trends stand out even more, and after big sales periods like the holidays, when traffic cools, saturated ASINs will show these limits faster than others. Comparing current data to past results for similar products or looking at competitor movement can help highlight underperformers as well.

Using benchmark dashboards and deeper reporting helps connect the dots faster. It isn’t enough to only check top-line totals. You’ll want to look across all ad types, creative cycles, and product groupings to get a full understanding of where exposure is dropping.

Strategies to Prevent and Fix ASIN Saturation

While the platform has its own ways of handling ASIN saturation, we can do a lot on our side to either stop it before it begins or manage it once it shows up.

Structure campaigns by goals, not just product. We separate ASINs based on purpose, whether it’s for launch, growth, or long-term rank defense

Rotate ad creatives frequently and vary formats to avoid being seen as repetitive

Shift targeting strategies. If one cluster of search terms hits the wall, we explore product or category targeting to move into different user flows

As a short-term fix, we pause or reduce spending on overlapping campaigns if they’re impacting one another. That often helps reset the performance trend before long-term damage builds

With regular testing, it’s possible to find the saturation point for most products, and then adjust so campaigns stay just below that limit. Making even small changes, like pulling back on overlapping keywords or switching up creative, can result in performance improvements almost right away. The goal is to allow each product to keep showing up fresh to shoppers.

What to Watch as Amazon Continues to Evolve

As we head deeper into 2026, it’s worth watching how changes in the broader market affect saturation patterns.

For example:

New supply chain delays or tariff adjustments might restrict product inventory, leading sellers to shift more ad budget to fewer ASINs

Growing use of AI tools can make it easier (or harder) to manage saturation, depending on how automation is applied

Amazon continues to roll out category tools, tag expansions, and reporting features that could help surface saturation faster

It’s another reason why sellers are investing in systems that can trigger alerts when impression share drops, when performance dips, or when campaign overlap increases. These tools help identify saturation before campaigns lose efficiency.

Thinking months ahead rather than chasing daily wins makes it easier to keep a product catalog balanced. Campaign plans that factor in product mix, market conditions, and upcoming policy changes are more likely to keep saturation at bay. Reassessing this strategy on a rolling basis lets brands adapt sooner rather than later.

Manage ASIN Saturation with Advanced Tools and Insights

Autron’s platform makes it easier to track performance by ASIN, spot saturation risks using AI-powered alerts, and develop campaign structures that adapt to evolving trends in real time. Features like benchmark dashboards and custom reporting give brands a clear advantage in recognizing exposure problems early, so sellers avoid wasted spend and performance drops. Automation built to support clear product-level goals can improve both flexibility and control as the platform evolves.

Step Ahead by Managing ASIN Fatigue Proactively

ASIN saturation isn’t something that just hits overnight. It tends to build quietly through small signs in our data. An increase in spend without returns. A flattening of impressions on our top products. A steady drop in click-throughs from known winners.

When we stay alert to those shifts and understand how the Amazon ads platform reacts, we’re in a stronger position to respond. Campaigns don’t have to break before they get better, and neither do our ASINs. With the right strategy, we can plan ahead, avoid unnecessary overlap, and keep each product performing at its best, even in a competitive ad environment.

Struggling with slow impressions or rising CPCs on repeat ASINs? At Autron, we help brands rethink campaign structure before performance takes a hit. Our strategies focus on product mix and clear goals, working with the logic of the Amazon ads platform to improve long-term growth. Let us help you manage saturation and stay flexible for better long-term returns. Contact us today to get started.

Adrian Steele

Content Writer

Jan 23, 2026